Credit cards serve as essential financial tools for individuals and businesses alike. However, while both business and personal credit cards offer similar benefits, they serve distinct purposes.

It is important to understand the differences between them to make the right decision for your specific needs. This article will provide an in-depth comparison of business and personal credit cards, helping you choose the one best suited for your financial situation.

What is a Personal Credit Card

A personal credit card is a financial product designed for individual consumers. It is used to make everyday purchases, from shopping to paying for services or travel. Personal credit cards are issued based on an individual's creditworthiness and personal financial profile.

Key Features of Personal Credit Cards

Credit Limits

Generally lower than business cards, based on personal income and credit score

Rewards and Benefits

Many personal credit cards offer cashback, travel points, or shopping discounts as rewards for spending

Usage

Ideal for everyday purchases, entertainment, travel, and other personal expenses

Interest Rates

Typically lower interest rates compared to business cards, although this can vary depending on the card issuer

What is a Business Credit Card

A business credit card is specifically designed for business expenses. It helps separate personal and business finances, allowing businesses to manage cash flow, pay for expenses, and track expenditures more efficiently. Business credit cards can be used for purchasing office supplies, business travel, and other company-related costs.

Key Features of Business Credit Cards:

Credit Limits

Business credit cards generally offer higher credit limits compared to personal cards to accommodate the larger expenses associated with running a business

Rewards and Benefits

Business credit cards often provide rewards tailored to business needs, such as travel points, office supply discounts, or business-related cashback offers

Expense Management

Offers tools that help businesses track and categorise expenses, making it easier to manage finances and prepare for tax filing

Interest Rates

Business credit cards tend to have higher interest rates due to the higher risk involved in lending to businesses

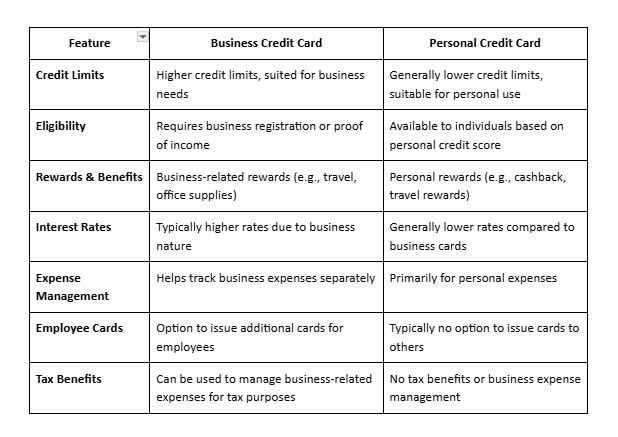

Key Differences Between Business and Personal Credit Cards

Advantages of Personal Credit Cardssn

1. Ease of Use

Personal credit cards are straightforward to apply for and manage, making them ideal for individuals looking to cover their day-to-day expenses.

Lower Fees

Personal credit cards typically have lower fees and interest rates compared to business cards, making them more affordable for individuals.

Rewards and Cashback

Many personal cards come with attractive reward schemes, including cashback, travel miles, or discounts on purchases, ideal for personal spending.

Advantages of Business Credit Cards

1. Separation of Finances

Business credit cards help keep personal and business expenses separate, making it easier to manage accounts, track expenses, and file taxes accurately

Employee Management

Business owners can issue additional cards to employees and track spending, improving control over company expenses

Business-specific Rewards

These cards often offer business-related rewards, such as discounts on office supplies, travel perks, and cashback for business-related purchases

How to Choose Between Business and Personal Credit Cards

When deciding between a business and personal credit card, consider your needs:

If you’re running a business

A business credit card is the best option. It helps you manage business expenses and offers benefits tailored to your business needs.

If you’re an individual consumer

A personal credit card is ideal for managing personal spending and rewards related to your everyday purchases.

For businesses, financial supermarkets like Bajaj Markets provide a platform where you can compare multiple business credit card options. These platforms allow you to find the best deals from different card issuers, offering business-specific benefits like higher credit limits, employee cards, and tailored rewards.

Conclusion

Choosing between a business and personal credit card ultimately depends on your specific financial needs. While both types of credit cards offer various benefits, understanding their key differences will help you select the card that best suits your situation.

Whether you’re managing business expenses or handling personal finances, the right credit card can provide valuable rewards, flexible payment options, and effective expense management.

Write a comment ...