Learn how to apply for an LIC Housing Finance Home Loan, including eligibility, required documents, and simple step-by-step application guidance.

Owning a home is a lifelong dream symbolising comfort and stability. LIC Housing Finance (LIC HFL) helps you achieve it through affordable home loans with flexible repayment options and simple eligibility terms. By understanding the process and keeping your documents ready, you can enjoy quick approval and a smooth loan journey, turning your dream of homeownership into a reality without unnecessary stress or financial burden.

Eligibility Criteria for LIC Housing Finance Home Loan

Understanding the eligibility criteria helps you confirm whether you qualify for an LIC Housing Finance home loan before applying:

You must be a resident Indian or an NRI applying to buy, build, or renovate a house or flat in India

Both salaried and self-employed individuals are eligible to apply for the loan

Your age should fall within the range set by LIC HFL, ensuring repayment is completed within your earning years

A stable monthly income and consistent employment or business history are key for loan approval

Maintaining a good credit score and clear repayment record strengthens your application and improves your loan terms

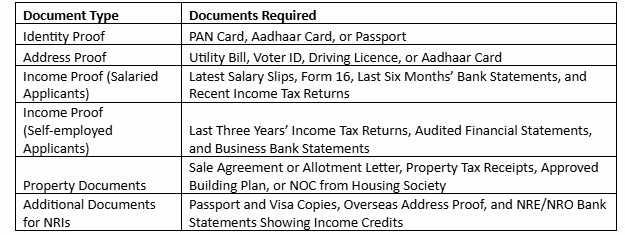

Documents Required for LIC HFL Home Loan

Having the right documents ready helps you complete your LIC Housing Finance home loan process quickly and without delays. Here’s a simple list of what you need to provide:

Loan Features and Repayment Terms

LIC Housing Finance offers flexible and customer-friendly home loan options that make buying or building your dream home easier and more affordable:

Loan Amount

The approved amount depends on your income, credit score, and repayment capacity, ensuring it aligns with your property’s value and financial comfort.

Repayment Tenure

You can choose a repayment period of up to 30 years, allowing you to manage EMIs conveniently without financial pressure.

Interest Rates

LIC HFL provides competitive interest rates based on your loan type and profile, helping you maintain long-term affordability.

Flexible Usage

You can use the loan for buying a ready property, constructing a new house, or renovating your existing home.

Prepayment Option

You can make partial or full prepayments to reduce your loan burden and save on overall interest costs.

Online EMI and Eligibility Calculators

LIC HFL’s website offers easy-to-use calculators that help you estimate your EMI, check eligibility, and plan your repayment better.

Step-by-Step Process to Apply for an LIC HFL Home Loan

Applying for an LIC Housing Finance home loan becomes quick and stress-free when you follow these simple steps carefully:

Check your eligibility based on age, income, job stability, and repayment capacity

Collect all required documents, including identity, address, income, and property proofs

Visit the official LIC Housing Finance website or your nearest LIC HFL branch to start the application

Fill out the loan application form with accurate personal, employment, and property details

Upload or submit the necessary documents for verification and eligibility review

Wait while LIC HFL verifies your information, credit score, and financial background

Receive your loan sanction letter once your application is approved successfully

Get your loan amount disbursed as per the approved terms and repayment plan

Tips to Improve Your Home Loan Approval Chances

Following a few smart practices can help you get quicker approval and better loan terms from LIC Housing Finance:

Maintain a strong credit score by paying your EMIs, credit card bills, and other dues on time

Share accurate income details and provide consistent bank statements to prove financial reliability

Apply for a loan amount that matches your repayment capacity to avoid rejection or strain

Keep all property documents clear, complete, and legally verified before submission

Avoid frequent job changes or gaps in employment, as lenders value income stability

Use the online EMI calculator to plan your repayments and choose a comfortable tenure

Avoid submitting multiple loan applications at once, as this can affect your credit score

Conclusion

An LIC Housing Finance Home Loan helps you turn your dream of owning a home into reality with ease and confidence. Its simple eligibility criteria, minimal documentation, and flexible repayment terms make financing more accessible for every borrower. Whether you’re applying for a loan or managing it later through services like LIC Housing Finance statement download online, the process remains quick and convenient. By planning ahead, keeping your documents ready, and following the right application steps, you can enjoy faster approval, affordable EMIs, and a smooth path to comfortable homeownership.

Write a comment ...